Nvidia has once again proven why it stands at the heart of the global AI revolution. In its fiscal Q1 2025 earnings report, the company posted an eye-watering $39.3 billion in revenue, marking a 12% jump from the previous quarter and a staggering 78% year-over-year increase. With full-year revenue topping $130.5 billion, Nvidia has officially more than doubled its earnings compared to last year. What’s fueling this surge? One word: AI.

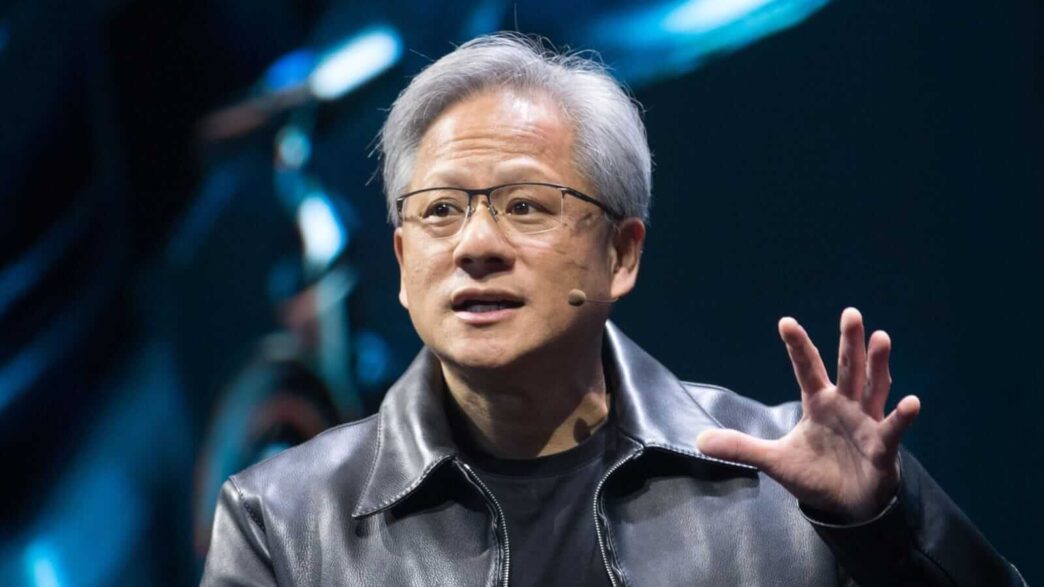

The backbone of Nvidia’s explosive growth is its Data Centre segment, now the company’s largest and most lucrative business unit. Cloud providers, AI startups, and enterprise giants alike are betting big on Nvidia’s AI infrastructure. CEO Jensen Huang has boldly declared Nvidia as the “AI factory” of the modern era, producing intelligence as the new industrial output.

This vision is coming to life through the Blackwell architecture, launched in 2024. Designed for ultra-demanding AI workloads like trillion-parameter models and real-time generative AI, Blackwell marks a major leap from its predecessor Hopper. March 2025 saw the debut of the Blackwell Ultra B300, which boasts 288GB of HBM3e memory and up to 10x faster inference for next-gen reasoning models.

In parallel, Nvidia’s DGX SuperPODs are becoming the go-to turnkey AI supercomputers. These systems bundle powerful DGX hardware, Base Command software, and high-speed AI networking into a plug-and-play solution. Research labs, enterprises, and hyperscalers have already purchased billions worth of these systems in just Q1 2025.

Expanding AI into Gaming and Visualisation

While Nvidia’s data centre business grabs headlines, its gaming and professional visualisation arms are quietly being transformed by AI as well. At GDC 2025, Nvidia launched DLSS 4 and showcased AI-powered tools like RTX Remix and Half-Life 2 RTX. These advancements enable hyper-realistic, real-time rendering that brings games to life like never before.

Nvidia ACE (Avatar Cloud Engine) is another standout, offering realistic speech, emotion, and interaction for non-playable characters (NPCs). This makes game worlds feel dynamic and deeply immersive—an innovation gamers have long craved.

Nvidia is also expanding its global footprint through deep partnerships with AWS, Google Cloud, Microsoft, and Oracle, helping them integrate Nvidia AI tools into everything from enterprise solutions to cloud infrastructure. On the climate front, Nvidia’s Earth-2 cloud APIs are now being used by Taiwan’s Central Weather Administration and The Weather Company to deliver hyper-realistic climate simulations 1,000 times faster and more energy-efficient than traditional models.

The Earth-2 system, powered by CorrDiff AI, opens doors to a $140 billion climate risk modeling market, offering high-resolution, real-time simulations that previously weren’t possible.

Facing Export Controls Head-On

Nvidia’s stellar growth hasn’t come without hurdles. U.S. government export controls have stifled sales of high-end chips like the H20 to China, triggering a $5.5 billion charge in Q1. These restrictions have put pressure on Nvidia’s market share in China and sparked CEO Jensen Huang’s criticism, warning that they could inadvertently boost Chinese competitors.

Even so, Nvidia is pivoting quickly. A new Blackwell-based AI chip designed specifically for the Chinese market is already in the pipeline to offset losses and maintain its footprint in Asia.

Looking forward, Nvidia’s innovation engine shows no signs of slowing. The company recently introduced NIM Agent Blueprints—pre-trained AI workflows for sectors like drug discovery and customer service—to make AI adoption more accessible.

And while rivals like DeepSeek in China are starting to make waves, Nvidia’s lead remains solid. After all, Nvidia still holds the title of the world’s second most valuable company. Its AI tools are not only changing industries—they’re reshaping the fabric of modern computing.

With momentum from Blackwell, global demand for AI compute, and expanding software tools, Nvidia is well-positioned to keep leading the AI infrastructure race into the next era of digital transformation.