French mobile app and gaming company Voodoo has reported €623 million in revenue for 2024, up 20% from the previous year. The Paris-based company also posted its second consecutive year of profitability, with EBITDA reaching €135 million—marking a 34% increase from 2023. Much of the company’s momentum comes from its core mobile gaming business, but one of the most talked-about developments this year is BeReal.

Voodoo acquired the Gen-Z photo-sharing app in mid-2023 for €500 million. Despite inheriting a loss-making, declining product, Voodoo says BeReal has now broken even and stabilized its user base.

Turning BeReal Around in Under a Year

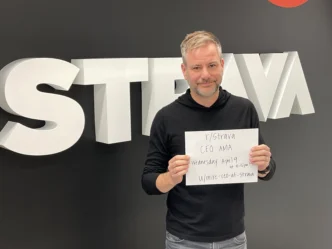

At the time of acquisition, BeReal was reportedly losing around €2.6 million per month and had yet to launch any monetization features. “The first objective was not to earn money but to break even,” said Voodoo CEO Alexandre Yazdi. That goal has now been achieved.

The company implemented light advertising and introduced new features, including video and chat, to increase engagement. Cost-cutting also played a role, with roughly 30 staff laid off. As of early 2025, BeReal generates around €1.7 million in monthly revenue and has a steady 30 million monthly active users.

“We would have liked it to be faster and to be growing already,” said Yazdi. “But we’ve managed to stabilize the business in just a few months. With two to three years, we believe we can build a resilient and profitable platform.”

Gaming Still Drives 90% of Revenue

Founded in 2013, Voodoo initially made its name in hyper-casual games—low-cost mobile games that can be developed in weeks and often go viral quickly. But in recent years, the company has shifted toward hybrid-casual games—longer-lifecycle titles with deeper gameplay, monetized through ads and in-app purchases.

Today, hybrid-casual titles account for 70% of Voodoo’s revenue. The company has 150 million monthly active users and reported 950 million downloads in 2024, with over half of its revenue coming from the U.S.

Yazdi says the next phase of growth could come from pure casual games—higher-complexity titles with long development cycles and revenue potential of up to €1 billion per game. That would put Voodoo in competition with giants like Supercell, which reported €2.8 billion in revenue and 300 million MAUs in 2024, and Zynga, acquired for $12.7 billion in 2022.

No IPO Yet, But Growth Plans Continue

Though Voodoo has raised €175 million in fresh funding—mainly to refinance existing debt—Yazdi says the company isn’t ready for an IPO just yet.

“For a successful IPO, you need a certain size and a resilient, predictable business,” he said. “We’re making progress on both, but we’re looking at a five-year timeline.”

M&A isn’t the core strategy, but Voodoo has completed about 20 acquisitions to date, including Israeli gaming studio Beach Bum for €300 million in 2021. The company says it’s keeping its eyes open for future acquisition targets to complement its organic growth.

Now valued at €1.7 billion and operating in over 250 countries, Voodoo is positioning itself as a global player in both mobile gaming and the Gen-Z social app space. With BeReal breaking even and hybrid-casual gaming fueling momentum, the company is betting on deep gameplay, high retention, and AI-enhanced monetization as the next phase of its evolution.