Aldea Ventures, a prominent fund of funds specializing in frontier technologies, has recently announced the €50 million close of its second fund, Aldea Fund II. This marks a significant step toward their €125 million target, as they continue to capitalize on the booming sector of deep tech. The new fund aims to back early-stage managers specializing in AI, robotics, next-generation computing, and more, all sectors forecasted to grow annually by 42%, vastly outpacing the traditional tech market’s 3% growth rate.

Aldea’s Unique Investment Strategy

Aldea Ventures, founded in 2020 in Barcelona, operates with a hybrid investment model that connects emerging micro VCs with follow-on capital for scaling startups. The company targets frontier technologies, offering early exposure to disruptive innovations. The fund’s strategy is built around specialized, high-growth sectors that are expected to revolutionize industries from climate tech to healthcare.

The firm’s latest investments include:

- Moonfire (a data-driven VC firm)

- Amino (a leader in health and biotech)

- Unruly Capital (focused on climate and deep tech)

These early-stage managers are at the forefront of technological breakthroughs, with Aldea Fund II set to further amplify their efforts.

A Hybrid Model to Fuel European Innovation

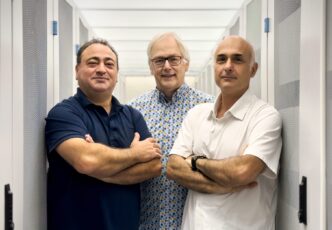

Aldea’s founders, Carlos Trenchs, Alfonso Bassols, Josep Duran, and Gonzalo Rodés, recognized a gap in the European venture capital landscape. Europe was producing a wealth of early-stage startups and micro VCs, but lacked a platform to support these emerging managers and help them scale. The solution: a hybrid investment model inspired by Silicon Valley’s success, designed to provide transparency, data-driven insights, and a robust ecosystem to accelerate innovation.

Alfonso Bassols, Managing Partner at Aldea Ventures, explains, “We see venture capital as a dynamic network that propels innovation. With Fund II, we are doubling down on early-stage specialist managers, giving them the support they need to uncover the next wave of breakthroughs.”

Fund II: Targeting Micro and Nano VCs

Aldea Fund II’s core thesis is to build a concentrated portfolio of Micro-VCs (funds under €100 million), supplemented by Nano-VCs (funds under €25 million). This strategy aims to increase profitability by tapping into emerging technologies while diversifying risk through co-investments and secondary opportunities.

Key investments in Fund II include:

- Moonfire II

- Amino II

- Lunar Ventures II

- Concept Ventures

- First Commit

Additionally, Aldea has secured Nano-VC investments with 201 Ventures and Possible Ventures.

Expanding Horizons: European and U.S. Ventures

While Europe remains Aldea’s primary focus, Fund II also targets selective U.S. exposure, especially for European pre-seed investments with the potential to expand into U.S. markets. This strategy aligns with Aldea’s broader vision, as 71% of startups backed by Aldea I were based in Europe, with 25% in the U.S.

Mick Halsband, General Partner at Lunar Ventures, shared, “Aldea has been more than just an investor; they’ve been a true partner. They align with our mission to back deep tech founders in Europe, understanding the complexities and long timelines of the industry.”

Aldea Ventures’ Vision: Empowering the Next Generation of Deep Tech

Aldea Ventures’ vision is to empower the next generation of deep tech innovation. Through Fund II, the firm continues to provide crucial support to highly specialized, early-stage managers investing in cutting-edge sectors such as artificial intelligence, robotics, climate tech, and healthtech. The firm’s mission is clear: to help emerging managers and startups scale, drive value, and tackle the world’s most pressing challenges.

Daniela Cavagliano, newly promoted Partner at Aldea Ventures, states, “The influx of innovative technologies today is critical for solving global challenges. At Aldea, we offer a well-diversified portfolio that provides high-value creation with low-risk exposure, making it a unique investment proposition.”

Conclusion

As Aldea Ventures continues its work with Fund II, they remain committed to empowering the next wave of frontier tech innovators. By backing specialized fund managers and leveraging their deep technological expertise, Aldea is positioning itself as a key player in Europe’s deep tech investment landscape. With its strong focus on AI, climate tech, and other high-growth sectors, Fund II promises to bring transformative technologies to the forefront, paving the way for disruptive innovations in the coming years.