There’s a new player in the world of AI tax automation software—and it’s aiming to transform an industry drowning in paperwork. Filed, a U.S.-based startup, just raised $17.2 million to bring its AI-powered tax engine to accounting firms across the country.

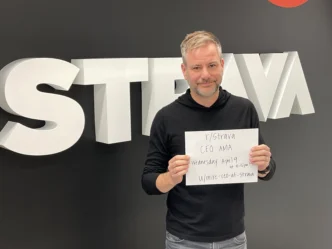

Led by CEO and co-founder Leroy Kerry, Filed wants to solve a growing crisis in the tax world. “The industry is facing a genuine crunch,” Kerry said. “Fewer students are becoming CPAs, and too many professionals are stuck doing work that should be automated.”

The platform’s promise is bold: reduce the time tax professionals spend on manual tasks by letting AI take over the tedious parts. Filed’s AI doesn’t just scan documents—it reads, reasons, and applies firm-specific tax strategies. When it spots something complex, it flags it for human review. That means professionals stay in control while automation handles the grunt work.

A New Approach That Doesn’t Disrupt Existing Systems

Filed is entering a crowded space, but Kerry says their edge lies in deep tax-specific workflow automation that plugs into firms’ existing tools. Unlike other platforms that require firms to replace software, Filed works within the systems they already use. It’s an approach designed for seamless adoption, especially for small offices still using faxes and paper files—something Kerry and his team saw firsthand during field research in Arizona and Colorado.

The startup’s $17.2 million round was led by Northzone, with backing from Day One Ventures and Neo. Filed plans to use the funding to expand its engineering team and develop more capabilities beyond tax return prep.

For Kerry, building a venture-backed startup wasn’t always on the radar. Raised in low-income housing in South London by a single mother, he rarely saw tech CEOs who looked like him. But he was determined. While still in school, he took a job at a call center, studied architecture at university, and was back working full-time the Monday after graduation.

Soon, he was managing teams and working with startups—one of which became a unicorn and offered him a role. That was his entry point into venture-backed tech. He later served as chief of staff at fast-growing companies in both the UK and Sweden before making the leap to launch Filed in the U.S.

His goal now? To become the AI infrastructure layer for the entire tax industry—not just filing returns, but also automating client communication, document workflows, and audit prep. “The tax industry has been waiting for its AI moment,” Kerry said. “We’re just getting started.”